Bei der Wahl von Online-Games stellt Millioner Casino einen faszinierenden Fallbeispiel dar. Die anwenderfreundliche Oberfläche zieht sowohl Anfänger als auch versierte Spieler an, und die breite Spielesammlung wirkt aussichtsreich. Zudem belegen fortschrittliche Sicherheitsmaßnahmen von einem Bekenntnis zu gerechtem Gaming. Neben diesen Eigenschaften bieten Nutzerbewertungen und Bonusprogramme wesentliche Einsichten in das Gesamterlebnis. Was macht Millioner Casino in einem stark umstrittenen Markt tatsächlich hervor?

Einführung über das Millioner Casino

In der Auswahl einer Online-Spielplattform fällt Millioner Casino als bemerkenswerte Wahl für Spieler auf, die ein zuverlässiges und spannendes Gaming-Erlebnis suchen.

Diese Plattform stellt bereit eine umfangreiche Sammlung von Spielen mit einer Reihe an Spielautomaten, Tischspielen und Live-Dealer-Optionen für verschiedene Präferenzen. Die Zulassung durch renommierte Regulierungsstellen garantiert den Spielern gerechtes Spiel und Sicherheit.

Darüber hinaus legt Millioner Casino großen Wert auf einen effektiven Kundendienst und stellt bereit Nutzern mehrere Kanäle, um ihre Anfragen schnell zu beantworten.

Die zahlreichen Zahlungsoptionen ermöglichen unterschiedliche Zahlungsmethoden und gewährleisten schnelle Transaktionen. All dies führt zu einer zuverlässigen Atmosphäre bei und positioniert Millioner Casino als anziehendes Ziel für Anfänger und erfahrene Gamer ebenso, die Wert auf Schutz und Qualität setzen.

Anwenderfreundliche Oberfläche

Aufgrund der benutzerfreundlichen Benutzeroberfläche von Millioner Casino haben Nutzer problemlos sofort ins Spielgeschehen starten.

Sie finden ein übersichtliches Layout mit übersichtlichen Bereichen, die die Navigation vereinfachen. Das obere Menü ordnet die Optionen strukturiert und ermöglicht so den raschen Zugriff auf Ihre liebsten Spiele und Funktionen. Jedes Spielbild wird von aussagekräftigen Informationen begleitet, sodass Sie auf einen Blick informierte Entscheidungen treffen können.

Darüber hinaus garantiert das responsive Design hervorragende Funktionalität auf allen Geräten, egal ob Desktop oder Mobilgerät. Die Ladezeiten sind minimal, wodurch Unterbrechungen minimiert und ein unterbrechungsfreies Nutzungserlebnis gewährleistet werden.

Die Anpassung Ihres Spielerlebnisses ist unkompliziert; die Einstellungen sind einfach erreichbar, sodass Sie Ihre Präferenzen problemlos anpassen können. Insgesamt zeichnet sich die Benutzeroberfläche von Millioner Casino durch Produktivität aus und ermöglicht es den Spielern, sich auf Planung und Unterhaltung zu konzentrieren, anstatt sich mit verwirrenden Designelementen auseinandersetzen zu müssen.

Spielauswahl und -vielfalt

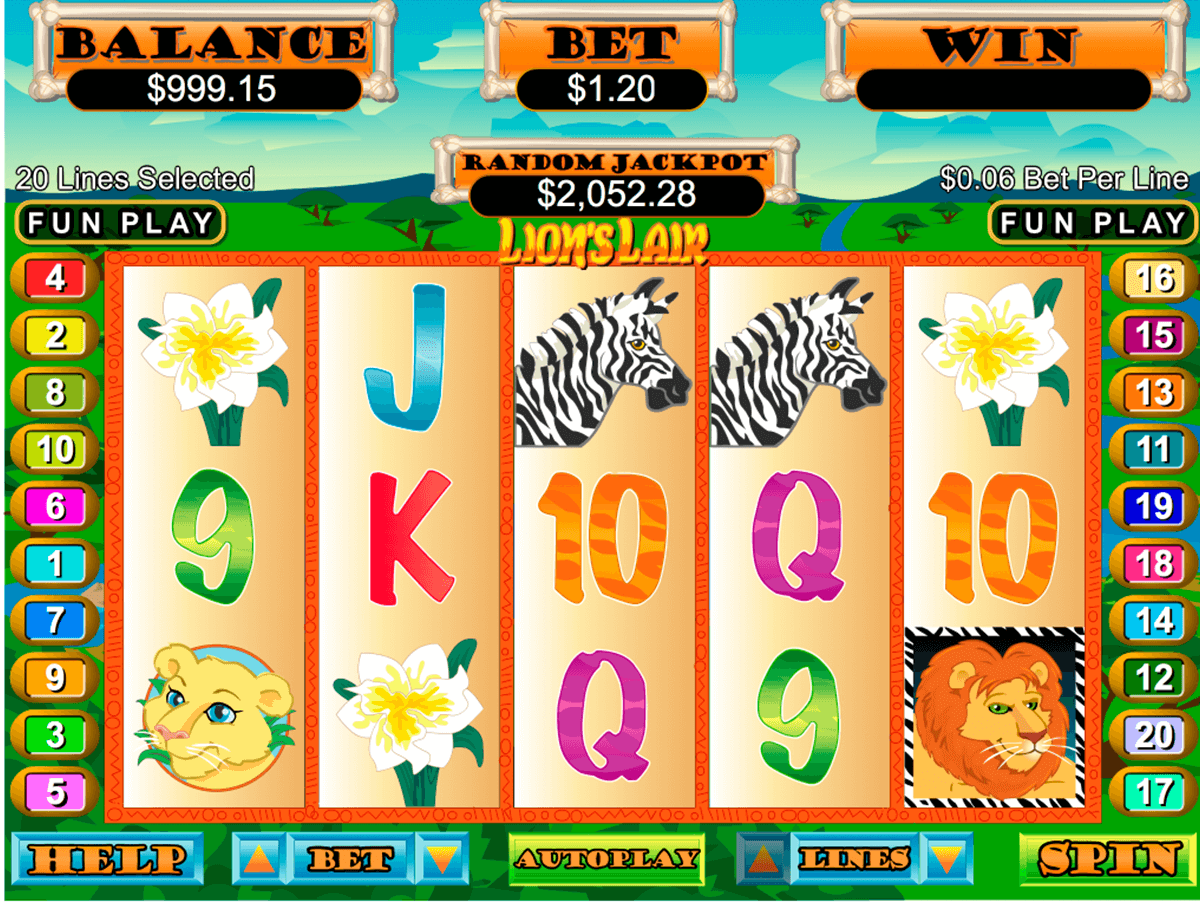

Bei der Erkundung der Spielauswahl im Millioner Casino finden Sie eine vielfältige Spielbibliothek, die unterschiedlichsten Vorlieben gerecht wird.

Diese Auswahl umfasst nicht nur bewährte Spielautomaten und Tischspiele, sondern bietet auch Live-Casino-Optionen für ein mitreißenderes Spielerlebnis.

Ein so beeindruckendes Angebot kann Ihr gesamtes Spielerlebnis und Ihre Spielbegeisterung erheblich steigern.

Umfangreiche Spielebibliothek

Im Millioner Casino können Spieler eine große Spielbibliothek mit zahlreichen von Titeln aus verschiedenen Genres erkunden.

Diese abwechslungsreiche Auswahl umfasst klassische Spielautomaten, neuartige Video-Slots, Tischspiele wie Blackjack und Roulette sowie unterschiedliche Themenvarianten für jeden Geschmack. Die Grafik und das Gameplay überzeugen durchweg mit erstklassiger Qualität und sorgen für ein optimales Spielerlebnis.

Das Casino arbeitet strategisch mit führenden Softwareentwicklern zusammen, um sicherzustellen, dass Ihre Auswahl regelmäßig mit neuen Versionen aktualisiert wird. Darüber hinaus ermöglichen Filterfunktionen die Fahndung nach Spieltyp oder Provider und vereinfachen so die Steuerung.

Live-Händleroptionen

Aufbauend auf der großen Spielbibliothek bietet Millioner Casino eine beeindruckende Kollektion an Live-Dealer-Optionen, die das Spielerfahrung noch weiter erhöhen.

Diese Live-Spiele umfassen Klassiker wie Blackjack, Roulette und Baccarat, die jeweils von erfahrenen Dealern in Echtzeit vorgeführt werden. Erleben Sie das HD Streaming, das für klare Bilder und ein immersives Spielerlebnis sorgt und Ihnen die Ambiente eines echten Casinos bequem von zu Hause aus bietet.

Die Vielfalt dehnt sich auch auf neuere Spiele mit neuartigen Regeln und Systemen, die unterschiedlichen Spielerpräferenzen gerecht werden. Wer interaktives Spielerlebnis sucht, kann sich mit Dealern und Mitspielern kommunizieren – das schafft eine einzigartige soziale Dimension.

Sicherheits- und Fairplay-Maßnahmen

Während viele Online-Casinos ein sicheres Spielerfahrung versprechen, zeichnet sich Millioner Casino durch strenge Sicherheits- und Fairplay-Maßnahmen aus, die dem Sicherheit der Spieler gewidmet sind.

Durch den Verwendung modernster Verschlüsselungstechnik garantiert das Casino die Geheimhaltung Ihrer privaten und finanziellen Daten. Darüber hinaus ist Millioner Casino von anerkannten Behörden zugelassen, was die Befolgung strikter regulatorischer Standards erfordert.

Das Casino verwendet RNGs, die regelmäßig geprüft werden, um faires Spiel in allen Spielen zu gewährleisten. Sie können darauf bauen, dass die Ergebnisse nicht manipuliert werden und somit für alle Spieler gleiche Chancen bestehen.

Millioner Casino fördert zudem sicheres Spielen, indem es verschiedene Tools zur Verfügung stellt, mit denen Sie Ihr Spielverhalten überwachen können. Dieser wikidata.org umfassende Ansatz erhöht nicht nur die Sicherheit, sondern etabliert auch eine vertrauenswürdige Spielumgebung für alle Spieler.

Kundensupport und Hilfe

Ein kompetenter Kundensupport ist ein wesentlicher Bestandteil einer zuverlässigen Online-Gaming-Umgebung und unterstützt die zuvor besprochenen Sicherheits- und Fairplay-Maßnahmen.

Im Millioner Casino erwartet Sie ein umfassendes Supportsystem, das Ihre Anfragen und Probleme schnell löst. Über verschiedene Kanäle wie Live-Chat, E-Mail und FAQ-Bereich erhalten Sie individuell zugeschnittene Unterstützung.

Die Reaktionszeiten sind in der Regel kurz, sodass Sie in wichtigen Momenten nicht verzögern müssen. Kompetente Mitarbeiter sind darauf trainiert, Probleme effizient zu lösen – ein Beweis für das Verpflichtung des Casinos für die Befriedigung seiner Spieler.

Darüber hinaus vereinfachen die gut strukturierten Support-Ressourcen das Auffinden von Antworten und tragen so zu einem störungsfreien Spielerlebnis bei. Letztendlich stärkt ein kompetenter Kundensupport Ihr Glauben in die Ehrlichkeit und Zuverlässigkeit der Plattform.

Werbeaktionen und Prämienprogramme

Im Millioner Casino erwartet Sie eine attraktive Auswahl an Promotions und Bonusprogrammen, die Ihr Spielerlebnis erhöhen und Ihre Gewinnchancen steigern.

Diese Offerten umfassen Willkommensboni für Neukunden, regelmäßige Reload-Boni und Treuepunkte, die mit jedem Einsatz gesammelt werden. Jede Promotion hat bestimmte Teilnahmebedingungen, Zeiträume und Umsatzbedingungen, damit Sie Ihre Vorteile optimal ausschöpfen können.

Oft aktualisierte Aktionen sorgen für eine lebendige und spannende Spielatmosphäre, während gestaffelte Treueprogramme konstantes Spielen honorieren und so Ihren Gesamtgewinn steigern.

Sie werden bemerken, dass die Teilnahme an diesen Programmen nicht nur für mehr Spannung sorgt, sondern auch taktisches Spielen fördert und Ihnen die Möglichkeit gibt, Boni effizient zu nutzen. Das Begreifen dieser Aktionen kann tatsächlich ein kritischer Faktor für Ihren Triumph am Spieltisch sein.

Spielerberichte und Erfahrungen

Bei der Überprüfung der Spielerbewertungen werden Sie auf wahre Geschichten stoßen, die besondere Spielerlebnisse im Millioner Casino hervorheben.

Diese Rezensionen spiegeln oft nicht nur Siege und Verluste wider, sondern auch die allgemeine Atmosphäre und die Qualität des Kundenservice.

Die Untersuchung dieser Geschichten kann nützliche Einsichten in das bieten, was Sie bei der Kommunikation mit dem Casino antizipieren können.

Wahre Geschichten von Spielern

Viele Spieler haben ihre Erfahrungen mit Millioner Casino mitgeteilt und dabei eine ganze Bandbreite an Gefühlen von Enthusiasmus bis Zufriedenheit zum Vorschein gebracht.

In den Erfahrungsberichten wird häufig das benutzerfreundliche Layout der Plattform betont, das eine flüssige Steuerung erlaubt. Spieler erwähnen oft die imposante Spielauswahl, was darauf deutet, dass diese Vielseitigkeit verschiedenen Geschmäckern und Fähigkeitsstufen entspricht.

Viele schätzen auch den reaktionsschnellen Kundenservice und berichten von zügigen Lösungen, was den Gesamtnutzen deutlich steigert. Darüber hinaus loben Benutzer häufig das klare Bonussystem, das sie als einfach und gerecht darstellen.

Dieses hohe Maß an Vertrauen zeigt ihr Bekenntnis für eine sichere Spielumgebung wider. Insgesamt offenbaren diese Erfahrungsberichte ein konsistentes Abbild: Die Spieler fühlen sich anerkannt und respektiert, was zu ihrer Loyalität und einer günstigen Wahrnehmung der Dienstleistungsqualität des Casinos führt.

Unvergessliche Spielerlebnisse

Eine Fülle denkwürdiger Spielerfahrungen prägt die Identität des Millioner Casinos, und Spieler berichten immer wieder von ihren aufregendsten Momenten. Diese Erfahrungen reichen von knappen Gewinnen an Tischen mit hohen Einsätzen bis hin zu überraschenden Jackpots an Spielautomaten und demonstrieren die Bandbreite des Angebots des Casinos.

Spieler heben immer wieder die fesselnde Atmosphäre und den exzellenten Kundendienst hervor, was zu einem Gefühl der Zugehörigkeit führt. Zusätzlich optimiert die strategische Anordnung der Spielfläche die Klarheit und Zugänglichkeit und ermöglicht einen fließenden Übergang zwischen verschiedenen Spielarten.

Zahlreiche Kundenbewertungen belegen dies: Das Casino bietet nicht nur Spiele, sondern schafft eine Umgebung, in der Spieler ihre persönlichen Erlebnisse schreiben können. Die Mischung aus Spannung, sozialem Austausch und Wettbewerbsgeist sorgt für unvergessliche Erfahrungen und stärkt den Ruf des Millioner Casinos als hochwertiges Spielhaus.

FAQ

Welche Zahlungsoptionen gibt es im Millioner Casino?

Bei der Auswahl von Zahlungsarten in Internet-Casinos haben Sie normalerweise Optionen wie Kreditkarten, E-Wallets und Überweisungen zur Verfügung. Um die geeignetste Option zu wählen, ist es entscheidend, die Kosten, Transaktionszeiten und Sicherheitsmerkmale jeder Methode zu bewerten.

Gibt es eine mobile App für Millioner Casino?

Ja, es gibt eine mobile App für Millioner Casino. Sie ist auf ein reibungsloses Spielvergnügen ausgelegt und bietet eine benutzerfreundliche Oberfläche sowie verbesserte Performance. Sie erhalten einfachen Zugang auf Spiele und Kontoverwaltungsfunktionen direkt von Ihrem Mobilgerät aus.

Existieren Auszahlungslimits im Millioner Casino?

Ja, die meisten Spielbanken, einschließlich Millioner, haben Auszahlungslimits. Diese Limits variieren in der Regel je nach Bezahlmethode und Spielerkontostatus. Daher ist es wichtig, die jeweiligen Bedingungen vor jeder Auszahlung zu überprüfen.

Können Spieler sich selbst sperren oder Grenzen für ihre Konten festlegen?

Ja, Spieler können sich selbst sperren oder Grenzen für ihre Konten festlegen. Diese Option ermöglicht es Ihnen, Ihr Spielverhalten effektiv zu steuern und verantwortungsvolles Spielen zu fördern, während Sie gleichzeitig die Kontrolle über Ihr Spielerlebnis behalten.

Bietet Millioner Casino Live-Dealer-Spiele an?

Ja, im Millioner Casino können Sie Live-Croupier-Spiele genießen. Diese Spiele bieten Ihnen die Chance, in Echtzeit mit professionellen Dealern zu interagieren und so Ihr Spielerfahrung zu optimieren. Es ist die perfekte Kombination aus Bequemlichkeit und Echtheit für erfahrene Spieler wie Sie.

![Galactic Wins Casino Review – Expert & Player Ratings [2025]](https://static.casino.guru/pict/785341/galactic_wins_casino_game_gallery_desktop.png?timestamp=1712674589000&imageDataId=827516)

![Fish Road [InOut Games] - Free Demo & Casino Money Mode](https://inoutgames.com/wp-content/uploads/2025/10/fish-road-tile-logo-2048x1356.png)